Get a Bond

Get to the Next Level

Do you want more out of your surety bond? We not only help contractors get the bond they need but also help them build a bond program. Your bond program should meet all your needs and have room for growth. Whether its your first contract bond or you are looking to stretch your bond capacity, we can help!

Bond Program Evaluation

We are happy to provide a free surety bond evaluations for your company. We perform benchmarking reports and can compare you with your competitors in the industry.

SBA Bond Program

Double (or more!) your bond program with SBA Bond guarantee program. Startups and previously declined contractors are welcome. Quick-App bond approvals up to $400,000 on contract bond with only minimal information.

Bonding Education Seminars

We provide bonding education training for contractors all across the United States. Notable courses include surety bond education, proper accounting for your bond program, banking, insurance and managing growth.

In-house Underwriting

We are proud to maintain a $2 million in-house bond underwriting authority for SBA backed bonds, allowing us to make quick decisions on surety bond approvals. We can help with bid bonds or payment bonds and performance bonds.

Partner Resources

We maintain relationships with top-tier trusted advisors in the industry. A good construction-oriented CPA, banker, insurance agent and attorney can be the difference between getting a contract bond approved or declined.

HOW WE WORK

THE BOND PROCESS

Do you need a bid bond, payment bond or performance bond? We believe education is paramount in helping our contractors be more successful and we give our clients the resources and knowledge to make the best decision for their company and bond needs. No matter if you are looking for the best bond rate, more bonding capacity, or even less or no indemnity (personal/spousal guarantees).

We are happy to provide the framework for your specific path once we’ve reviewed the paperwork you provide. Starting with a deep dive we can show you a detailed financial analysis and explain what the numbers translate to in terms of your bond program and approval. From there its what you do with the information that determines your bond rate and overall bond program. The key is to be aware of your options and make the best choice that works for you and your business.

FIRST STEP

Your Needs

Fist we perform an initial intake to determine the best program for you.

Some bonds can be approved in less than a couple hours, and some can take more time.

Call us so we can discuss your needs!

SECOND STEP

Bond Package

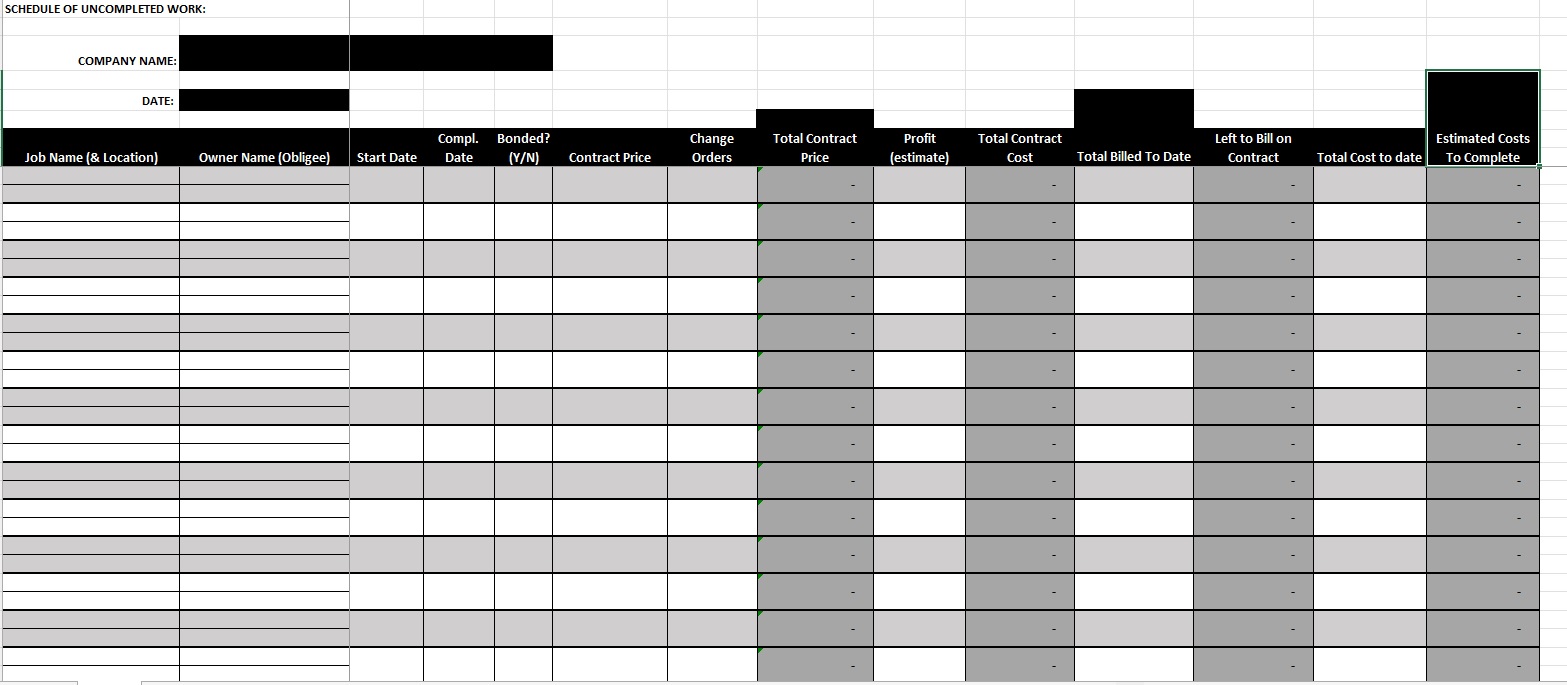

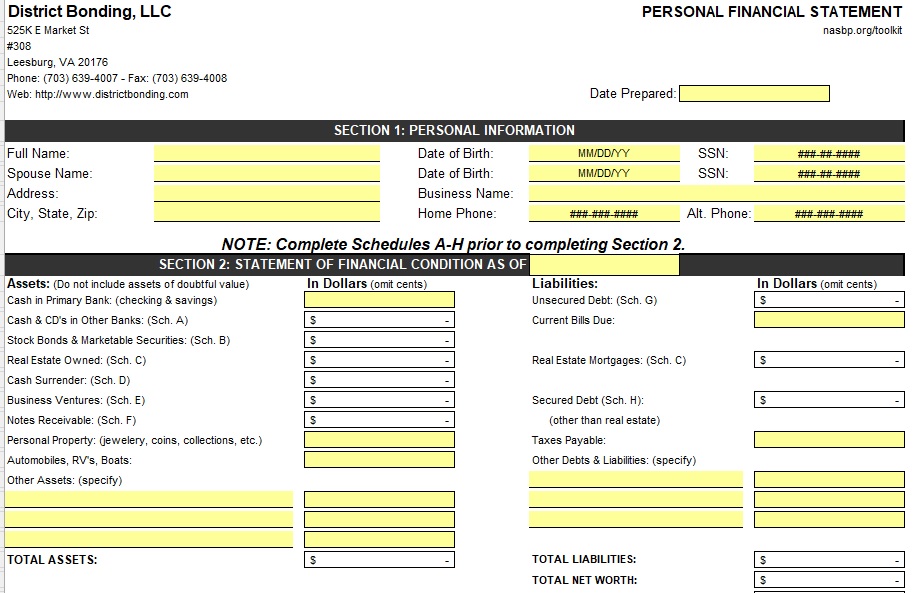

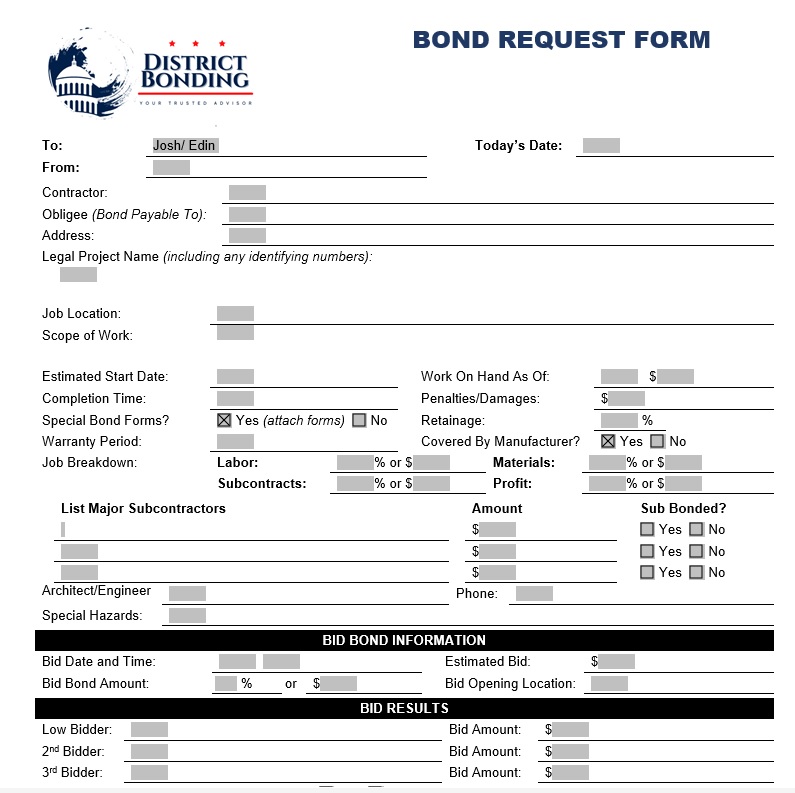

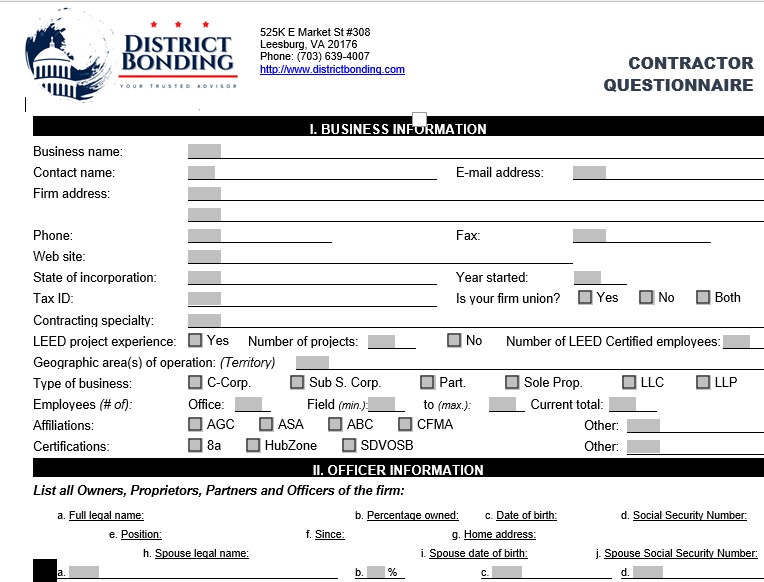

After the intake, we will email you a bonding package for completion.

Depending on your answers, it could be a simple one-page application for a small bond, or a more detailed one for a multi-million dollar bond!

Then, its up to you – how you complete this package is key to determining your approval, rate and capacity.

THIRD STEP

The Right Surety

Finally once we receive your application, we perform our in-house underwriting to determine the best market for you.

The stronger your submission is, the better!

Once we clear up any questions, we submit to a surety company for support of your bid bond or payment bond needs!

BOND PROGRAMS

DO YOU WANT A BETTER

Bond Rate?

Quick approval bond programs can provide bonds up to $750,000 based on a simple 1-2 page application, but the rates are generally higher. This program will consider bid bonds or payment bond.

Less information submitted to a bond company usually means a higher bond rate and limited capacity.

The more information you provide (company history, financials, references, etc.) the better likelihood you have of improving your bond rate and capacity.

DO YOU WANT MORE

Bond Capacity?

If you feel that your current surety relationship is limiting your capabilities, there are options for you.

Sometimes, you’re with a surety company that doesn’t understand your business, or an agent that doesn’t specialize in bonds (like us!).

There is also the SBA Bond Guarantee Program that can double (or more!) your bonding program from what the standard market would offer. The SBA will consider bid bonds or payment bond and performance bond.

DO YOU WANT TO LIMIT

Personal Guarantees?

You laid it all out on the line when you started your company.

Now, you’ve got a company that can stand on its own, but you’re still on the hook for personal and spousal guarantees.

Preparing a bond package for a new bond company to review allows for a fresh set of eyes (and perspective) towards removing your personal guarantees.

We are

Bond Experts

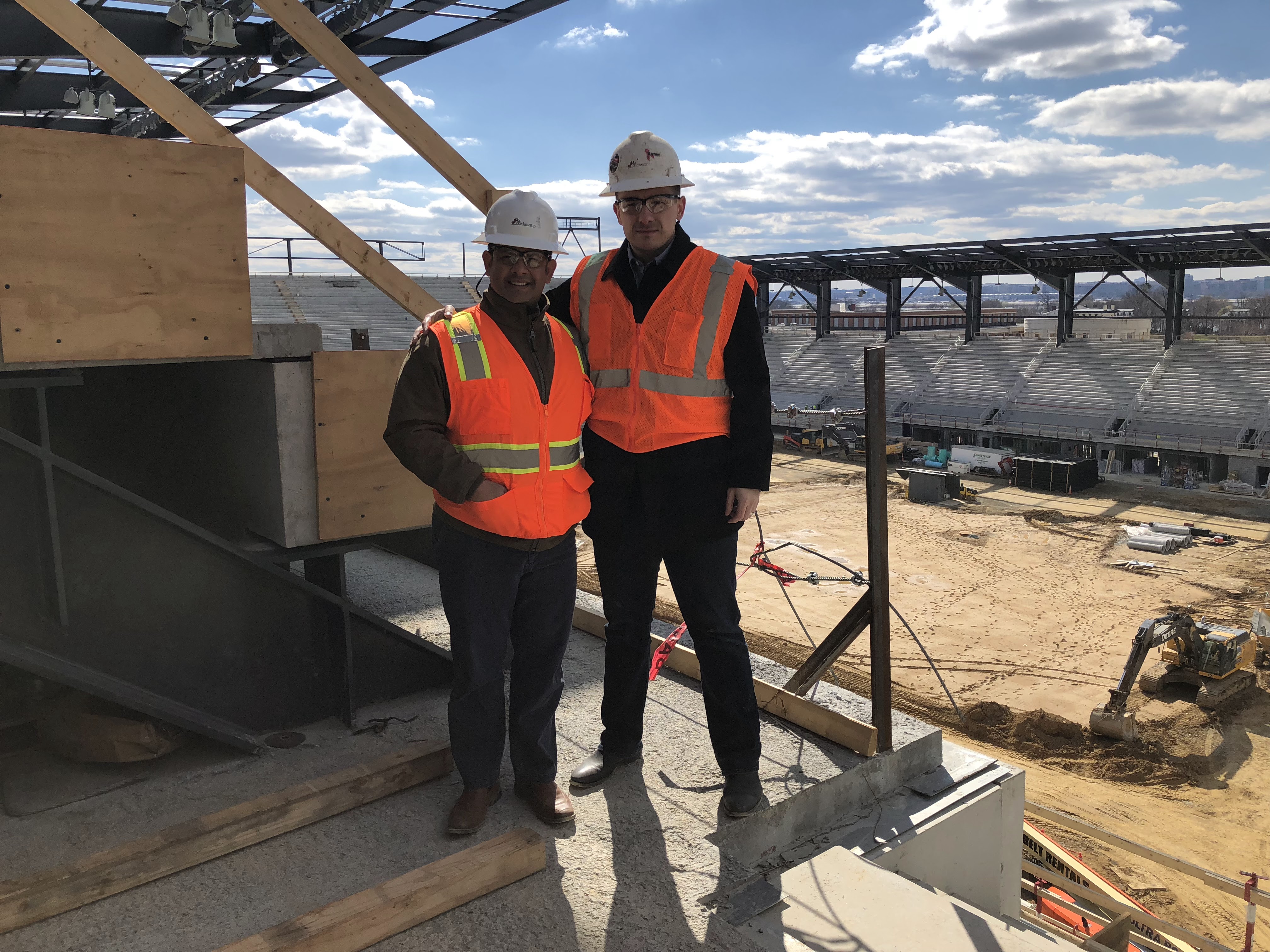

District Bonding was founded under a simple principle: build trust with our clients through sound advice and education. In doing so, we will help our clients grow their bond capacity and in turn, achieve their business goals, whatever they may be.

The owners, Edin Zukanovic and Joshua Etemadi bring with them over 30 years of combined surety bonding experience.

Excellent Customer Service

Commitment To The Construction Industry

Consultative Approach

Your Trusted Advisor

Learn about us